Stellar‘s native token XLM posted a modest gain in the 24-hour window through Sept. 8, rising about 2.32% from $0.36 to $0.37. The market settled into a very tight trading band — lows at $0.36 and highs at $0.37 — a $0.01 range that highlights near-term balance between buyers and sellers.

Trading activity showed institutional-sized interest. Volume peaked at 129.15 million tokens at 14:00 on Sept. 7, and the final hour of the observation period recorded more than 2.5 million units, which supported the advance to $0.37. That combination of high intraday turnover with a narrow price range often signals accumulation rather than distribution, suggesting sustained institutional buying is underpinning the $0.36 support level.

Corporate developments are reinforcing investor confidence. Paxos‘s entry into the Stellar ecosystem — including its USDH stablecoin strategy and the acquisition of Molecular Labs — is a notable strategic milestone. With more than a decade of regulated stablecoin issuance experience and plans to align USDH with the GENIUS Act and Europe’s MiCA rules, Paxos adds a layer of institutional-grade infrastructure that could attract more corporate flows to Stellar-based rails.

Technically, chart indicators point to an established support at $0.36 and an emerging upward price channel. A decisive break and close above the $0.37 resistance on sustained volume would increase the probability of additional upside, while failure to hold the $0.36 floor could expose XLM to renewed selling pressure.

Risk considerations: Ongoing regulatory debate around the GENIUS Act and broader stablecoin policy creates uncertainty. Market structure can change quickly, and technical breakouts are not guarantees of sustained rallies. Investors should weigh liquidity, order-book depth and upcoming corporate announcements before positioning.

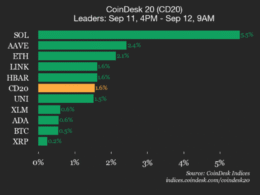

What to watch next: sustained volume above recent averages, a confirmed daily close beyond $0.37, on-chain flows tied to custodians or exchanges, and updates from Paxos on USDH compliance. Source: CoinDesk. Read the original coverage for full details.