U.S. spot Ethereum ETFs experienced a sharp pullback this week, posting a combined $787.6 million in outflows across four trading days from Sept. 2–5. The exodus peaked on Thursday when funds recorded a $446.8 million single-day withdrawal, one of the largest since the ETFs launched.

Outflows were concentrated in major products: Grayscale’s ETHE saw the biggest single-day hit with $309.9 million leaving on Sept. 5, while Fidelity’s FETH recorded a $216.7 million outflow on Sept. 4. BlackRock’s ETHA posted mixed flows, taking in $148.8 million on Sept. 4 before reversing the next day.

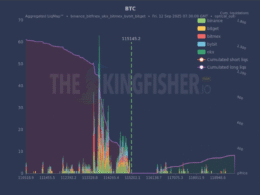

By contrast, Bitcoin ETFs showed relative resilience during the same window. They logged strong inflows early in the period — $332.8 million on Sept. 2 and $300.5 million on Sept. 3 — and finished the four days with net inflows of about $250.3 million despite subsequent outflows.

Analysts point to two overlapping drivers behind the rotation: profit-taking after a buoyant August and a renewed risk-off tone in macro markets. Farzam Ehsani, CEO of VALR, suggested institutional desks were simply locking gains. Others, including Konstantin Anissimov of Currency.com, emphasized structural disadvantages for U.S. Ethereum ETFs — notably that they cannot stake holdings — and described ETH as a higher-beta asset that gets sold first when risk appetite wanes.

Market data reflects the divergence: Ethereum traded near $4,304, down about 3.3% over the past week, while Bitcoin sat around $111,811, up roughly 2.1% for the same period. At the same time, on-chain data from Santiment shows large ETH holders increasing positions by about 14% over five months, a sign that longer-term investors remain active.

Why it matters: ETF flows can amplify short-term price moves but don’t necessarily signal a change in fundamentals. Ethereum’s network metrics — staking growth, DeFi activity and overall network health — remain robust, which suggests the outflows may be timing- and sentiment-driven rather than a verdict on long-term value.

Risk note: ETF flows and short-term rotations introduce volatility. Investors should consider their time horizon and risk tolerance before adjusting positions based on fund flow headlines.

Source: Decrypt. Read the original coverage for full details.