XRP printed a spinning bottom candlestick on Monday — a pattern that forms when price swings widely intraday but closes near its open, showing indecision between buyers and sellers. The setup is notable because it appeared after a roughly 25% pullback from the July high of $3.65 and near a key support level around the August 3 low.

Technically, the immediate focus is Monday’s high at $2.84. Traders typically look for a follow-through candle that closes above that level to confirm the reversal signal. At the time of writing XRP is trading around $2.80, just below that confirmation threshold.

That said, the short-term momentum picture is mixed. The 5- and 10-day simple moving averages remain downward-sloping, and the Guppy multiple moving average band has recently turned bearish — both signs that sellers still have the edge. If Monday’s low of $2.69 is breached, XRP may resume a sharper decline toward lower support levels, including the 200-day SMA at $2.48.

On the momentum side, the MACD histogram has been negative since late July, but price action has held in a relatively narrow range between roughly $2.70 and $3.00. That resilience leaves room for a potential MACD bullish crossover, which could accelerate gains if it arrives alongside price closing above $2.84 — a pattern similar to dynamics seen in other markets before sharp rallies.

Key technical levels: Support — $2.69 (Monday low), $2.65 (May swing high), $2.48 (200-day SMA). Resistance — $2.84 (Monday high), $3.38 (August high), $3.65 (July high).

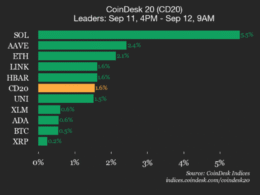

For context across markets, Bitcoin has cleared a descending trendline from record highs but still trades below major resistances such as the Ichimoku cloud and the 50- and 100-day SMAs. That broader environment suggests any XRP upside could meet selling pressure until higher-timeframe resistances are overcome.

Risk note: A spinning bottom signals potential change in sentiment but is not a guarantee of a sustained rally. Traders should wait for confirmation, manage position sizes, and be prepared for a break below Monday’s low, which would invalidate the reversal case.

Source: CoinDesk. Read the original coverage for full details.