Public companies are increasingly treating Bitcoin as a reserve asset, shifting a once-taboo idea into mainstream corporate strategy. According to BitcoinTreasuries, publicly listed firms now hold more than 4.7% of Bitcoin’s 21 million supply, driven by an expanding cohort of treasury-focused firms, miners and exchanges.

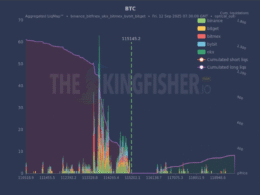

The biggest holders include: Strategy (formerly MicroStrategy) with 632,457 BTC (over $68 billion, ≈3% of total supply); miner Marathon Digital with 50,639 BTC; soon-to-be-public treasury firms Twenty One (XXI) (expected ~43,514 BTC) and Bitcoin Standard Treasury (30,021 BTC); exchange Bullish with 24,000 BTC; Japan’s Metaplanet with 20,000 BTC; miner Riot Platforms with 19,239 BTC; Trump Media (estimated 15,000 BTC); miner CleanSpark with 12,703 BTC; and exchange Coinbase holding 11,776 BTC.

These holdings come from diverse strategies: some firms accumulate BTC directly for treasury purposes, miners add newly minted coins, and exchanges convert IPO or fund proceeds into Bitcoin. The trend tightens available supply and signals stronger institutional adoption, which can amplify price moves and market attention.

Risk considerations: corporate treasuries expose shareholders to Bitcoin’s volatility and regulatory uncertainty. Allocation plans can change quickly—through sales, financing needs or governance votes—so holdings listed here are snapshots, not guarantees.

What to watch next: follow SPACs and IPOs that promise Bitcoin treasuries, mining firms scaling after halving cycles, and any regulatory developments affecting corporate custody or disclosures.

Source: Decrypt. Read the original coverage for full details.